Italy's tax break for foreigners who transfer their residence to Italy is one of the factors that in recent years is spurring more and more wealthy foreign citizens to invest in luxury real estate in the "Bel Paese" country. The trend is highlighted by Knight Frank’s latest Wealth Report, the global study that examines the investments of “Ultra-high-net-worth individuals” (UHNWs), people with assets in excess of $30 million.

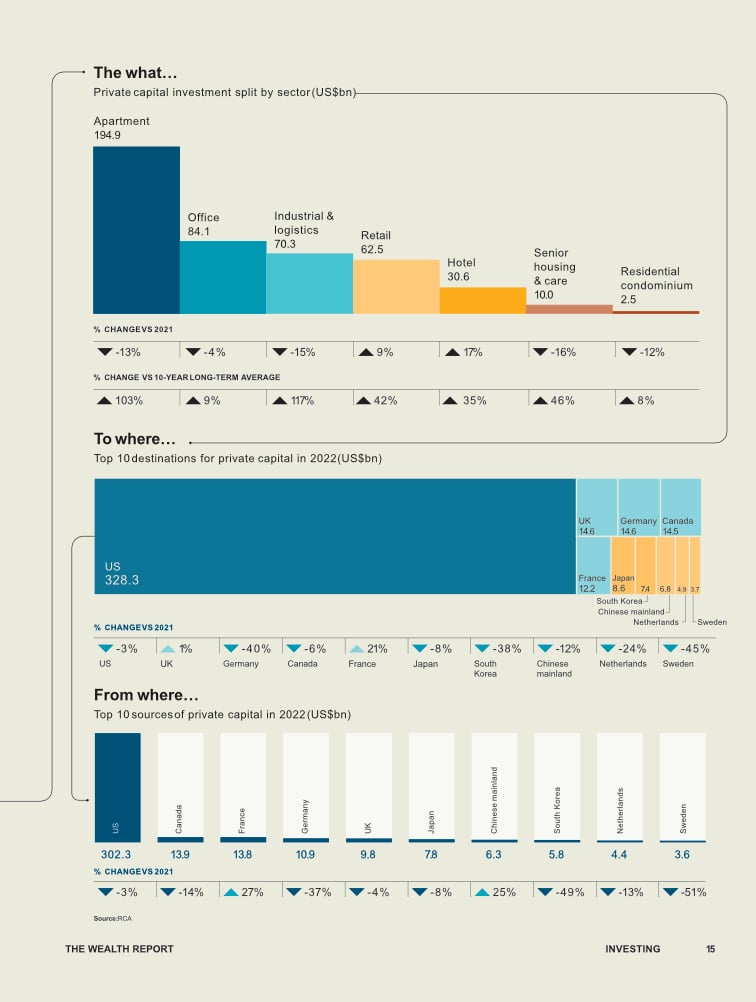

According to Knight Frank's report, investment in residential real estate accounts for about a third of the assets of the so-called UHNWs, and Italy is confirmed among the favourite destinations chosen by foreign investors, Americans and Germans in the lead.

Attracted not only by the desire to improve the quality of one's life, being able to enjoy a mild climate and large outdoor spaces, a great boost to investment in Italy is given by the advantageous tax conditions guaranteed by the new fiscal measure.

The pandemic has given new buoyancy to the real estate market which, in a short time, has seen an investment growth of almost 50% compared to three years ago by wealthy foreigners who, with increasing frequency, choose to buy luxury residential properties in Italy.

Flat Tax in Italy: how it works

The Flat tax in Italy allows paying a flat tax of 100,000 euros, regardless of income, in a lump sum valid for 15 years. It is also applicable to family members, who are required to pay a flat rate of 25 thousand euros.

The latest provisions of the Court of Auditors relating to 2021 in reference to the 2016 law championed by the Renzi Government regulate the tax conditions of those who transfer residence to Italy and who can, therefore, take advantage of reduced taxation. The measure was proposed with the intention of attracting foreign investors to Italy, particularly designed to stem the negative effects of Brexit, and to ensure the movement of capital.

The basic intention was to create favourable conditions for those who enjoy high incomes produced abroad, and who want to transfer their residence to Italy.

In more detail: the Flat tax in Italy asks for a flat-rate taxation of 100,000 euros for earnings accrued abroad, regardless of the income generated in the country of origin. As for the profits produced in Italy, the percentage taxation persists but with a lower tax base, more or less discounted according to the region chosen for the new residence, but which is around 30%.

Taxes in Italy for foreigners: what to do to be eligible for the Flat Tax

The tax regime provides for a special management of taxes in Italy for foreigners that depend on the tax return relating to the tax period in which they are resident in Italy. It is, therefore, good practice to request a ruling from the Italian Financial Administration to be certain of the applicability of this new regime.

What should the request contain?

- personal data, Italian tax code (if already assigned), and address of residence in Italy

- non-resident status in Italy for a period of time equal to at least 9 tax periods out of the previous 10.

- jurisdiction or jurisdictions of last tax residence before the request

- States or foreign territories for which the subject intends to exercise the right not to use the substitute tax;

- existence of the necessary elements to verify the conditions of access to the substitute tax regime on income produced abroad, by filling out a special check list prepared by the Revenue Agency and the presentation of the relative documentation.

Italian taxes for expats: benefits for purchasing a primary residence

The incentives that ensure benefits concern the purchase of the primary residence: in Italy, you cannot be the owner of another home on national territory. The Italian taxes for expats regime establishes that in the case of a foreign buyer, it is not necessary that the residence correspond to the address of the home purchased in Italy, as it is not mandatory to have residence on national territory but you can live and work permanently elsewhere.

A further distinction concerns the methods of purchase of the property: if the sale comes from a private individual, the buyer must pay a registration tax of 2%, whereas in a sale involving a company subject to VAT, the value added tax will be 4%.

Income tax in Italy: the "Workers relocating to Italy" scheme

The so-called “Workers relocating to Italy” scheme allows foreign workers to enjoy lower tax rate brackets on income from employment or self-employment. According to the Income tax in Italy, expats must declare only 30% of their profits, for 5 years. This measure varies on a regional basis, so much so that in some Italian regions such as Abruzzo, Molise, Campania, Puglia, Basilicata, Calabria, Sardinia or Sicily the tax base is 10%.

Those who decide to spend their retirement in Italy are required to pay 7% on foreign income, provided that they move to municipalities with at least 20,000 inhabitants.

Italy tax rate: what American citizens need to know

American citizens in Italy are subject to a double taxation system based on two different tax regimes. First of all, to define the Italian tax rate, it is necessary to submit an annual tax return, and this is due regardless of whether the place of residence is in Italy or in the United States.

Once they have taken up residence in Italy, US citizens can also be subject to Italian jurisdiction.

Those who are resident in Italy are subject to global income tax, therefore taxation on all forms of income, even income accrued abroad. For non-residents, on the other hand, the taxation concerns only the income accrued in Italy deriving from work or investments.

It follows that those who do not live in Italy permanently, or who have not spent more than 183 days in Italy in a year, are not considered residents for tax purposes, although they could still be subject to tax returns relating to the income generated in the country. An example is the possession of property, for which a tax rate of 0.5% on the first house and 0.86% on the second is required.

To be considered residents for tax purposes and be able to benefit from the Italian tax rate, US citizens must register with the general Register Office of the municipality where they intend to reside and take up residence or domicile in Italy, a condition that implies having found a place of economic and social interest.

A tax treaty exists between Italy and the United States that allows US citizens to enjoy several tax benefits, excluding certain types of income from taxation and preventing those who work in both countries from being subject to a double tax regime.

Italian taxes for expats after Brexit

Until 2020, residence of UK citizens on Italian territory was regulated by a specific legislative decree that established the possibility of requesting a certificate of permanent residence for all those who had resided in Italy for at least 5 years. Italian taxes for expats after Brexit provide different conditions since, formally, British citizens are non-EU.

From 1 January 2021, all British citizens already residing in Italy on 30 December 2020 can request a regulatory document from the Withdrawal Agreement between the United Kingdom and the European Union. This handbook, to be requested at the Police Headquarters of residence, allows enjoying the rights recognized by the Agreement for oneself and for family members, and is actually a residence document in electronic format.

This document remains valid for 5 years, 10 if the person already enjoyed the "permanent stay" status mentioned above, which is obtained by staying in Italy for a continuous period of 5 years, including the time before and after 31 December 2020.

Knight Frank's Italian real estate market overview

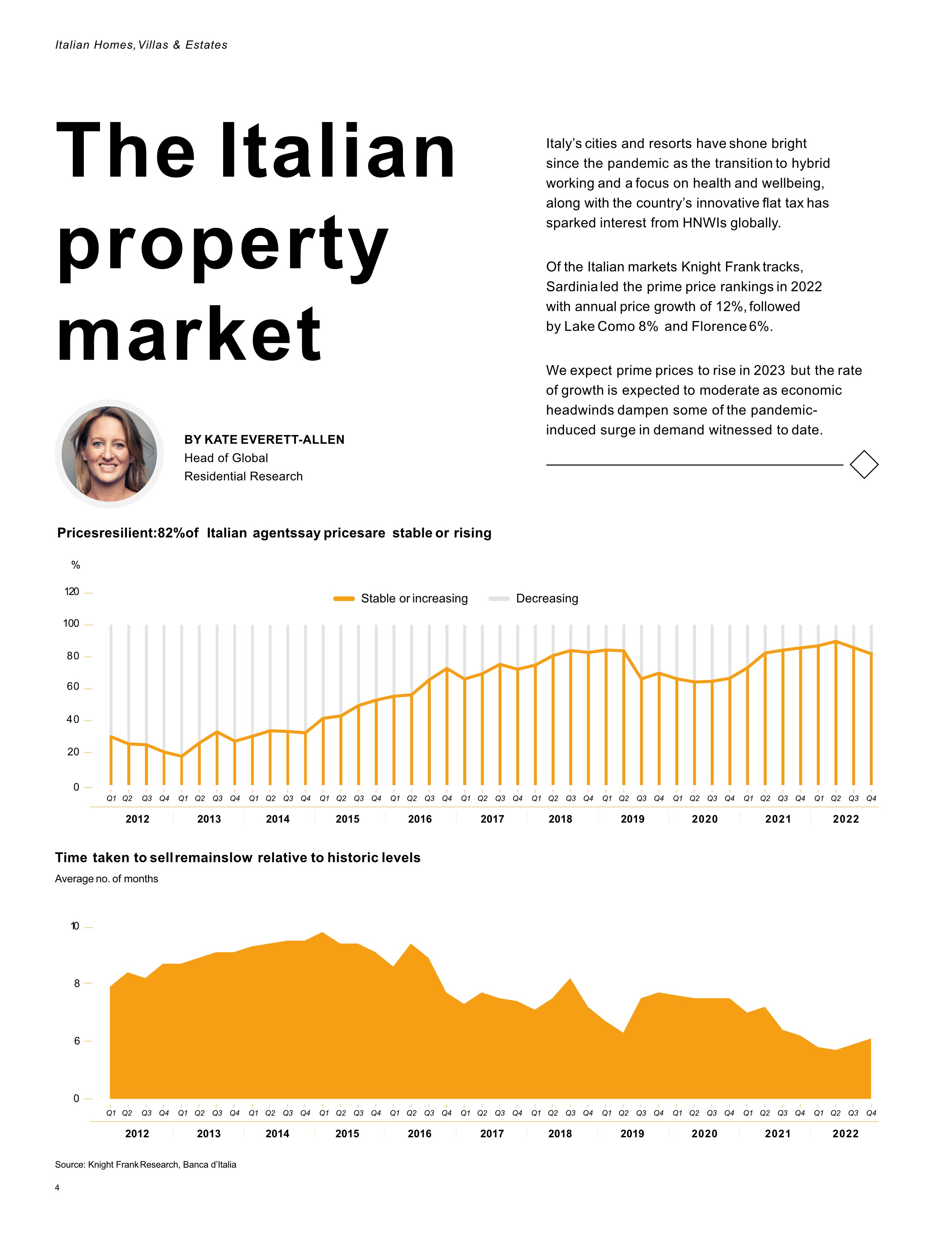

The market analyses conducted by Knight Frank confirm the growing trend of the Italian real estate market: the tax breaks, with the Flat tax in Italy in the lead, which have attracted an increasing number of foreign buyers to Italy, has uograded the prospects of the Italian market from prime to super-prime. The data suggest that by 2026 about 20,000 ultra-wealthy people will decide to move to Italy from their countries of origin.

Compared to the previous year, 2021 saw a 30% increase in home requests in Tuscany, a region that has attracted 66% of total requests in Italy.

The Chianti and Florence areas, which recorded a 37% increase in the number of non-residents, attracted the most interest in 2021, for a total of 31% of all property requests, followed by Lucca, Pisa and Bolgheri, for a total of 24%.

The average price of the properties proposed by Knight Frank is around 3.7 million euros, an increase of 8% compared to 2020: stable and significantly lower than the average is the price of properties in Lucca and Pisa, which is around 1.7 million.

As far as Italy as a whole is concerned, in 2022, the average change in prices of the main residential markets was around 6.5%, exceeding the global average of 5.2%, and the percentage of sales above the requested price exceeds 11%.

Statistical data suggest that first-choice prices will continue to rise throughout 2023, but the growth rate is expected to slacken as a natural consequence of the pandemic-induced decline in demand for real estate.

In the light of the analyses carried out, we can safely state that Italy is in third place in the real estate market for high-quality properties, immediately following France and Spain.

Tuscan locations such as Florence, Siena, Pisa and Lucca enjoy medium-high level positions in the ranking of cities preferred by foreign investors based on parameters of accessibility – since geographically they are located in positions that facilitate travel, given also the proximity to important international airports – of the quality of life, and of cultural, historical and artistic contexts.

Would you like to receive updates on the luxury real estate market in Tuscany?

Fill out the form to subscribe to our newsletter and stay updated on the properties for sale and the main news in the sector.